A business budget plan should be done before you even start the business and make sure to just make studies if it is still applicable to your business operations every month or every year. To create an effective business budget document, you must first be able to recognize the amount that you are to start with in the business and the expected income that you are to get from it You should: look at how your fixed costs differed from your budget check that your variable costs were in line with your budget - normally variable costs adjust in line with your sales analyse any reasons for changes in the relationship between costs and turnover analyse any differences in the Business plan vs. budget: The scope. A budget only includes a financial forecast, whereas a business plan will also detail the commercial opportunity and the market, the company and its organisation and strategy over the next few years. The scope of the business plan Estimated Reading Time: 3 mins

Budgeting and business planning

Not sure where to start? The best budgets are simple and flexible. If circumstances change as they doyour budget can flex to give you a clear picture of where you stand at all times. This is the amount you expect to make from the sale of goods or services, budget business plan. This is the first line on your budget. Further reading: Fixed Costs Everything You Need to Know. Variable costs might include raw materials, inventory, production costs, packaging, or shipping, budget business plan.

Other variable costs can include sales commission, credit card fees, and travel. A clear budget plan outlines what you expect to spend on all these costs. The cost of salaries can fall under both fixed and variable costs. For example, your core in-house team is usually associated with fixed costs, while production or manufacturing teams—anything related to the production of goods—are treated as variable costs.

Make budget business plan you file your different salary costs in the correct area of your budget, budget business plan. Further reading: Variable Costs A Simple Guide. One-off costs fall outside the usual work your business does. These are startup costs like moving offices, equipment, furniture, budget business plan software, as well as other costs related to launch and research.

Cash flow is all budget business plan traveling into budget business plan out of a business. You have positive cash flow if there is more money coming into your business over a set period of time than going out. This is most easily calculated by subtracting the amount of money available at the beginning of a set period of time and at the end.

Since cash flow is the oxygen of every business, make sure you monitor this weekly, or at least monthly. You could be raking it in and still not have enough money on hand to pay your suppliers.

Profit is what you take home after deducting your expenses from your revenue. Growing profits mean a growing business. A budget calculator can help you see exactly where you stand when it comes to your business budget planning. It might sound obvious, but getting all the numbers budget business plan your budget in one easy-to-read summary is really helpful.

In your spreadsheet, create a summary page with a row for each of the budget categories above. This is the framework of your basic budget. Finally, create another column to the right—when the time period ends, budget business plan, use it to record the actual amounts spent in each category.

Pro tip: link the totals on the summary page to the original sums in your other budget tabs. That budget business plan when you update any figures, budget business plan, your budget summary gets updated at the same time. The result: your very own budget calculator. You can also check out this simple Startup Cost Calculator from CardConnect. It lays out some of the most common expenses that you might not have considered.

From there, you can customize a rough budget for your own industry. Forecasting in this way helps you spot annual trends, see how much money you need to get you through the slow months, and look for opportunities to cut costs to offset the low season. You can use your slow season to plan for the next year, negotiate with vendors, and build customer loyalty through engagement.

Just like any budget, budget business plan, forecasting is a process that evolves. The main budgeting factor for ecommerce is shipping. Shipping costs and potential import duties can have a huge impact. Do you have space in your budget to cover shipping to customers?

Packaging can affect shipping rates, so factor that into your cost budget business plan goods sold too. If you need to stock up on inventory to meet demand, factor this into your cost of goods sold.

The volume of inventory might affect your pricing. For example, if you order more stock, your cost per unit will be lower, but your overall spend will be higher. When creating custom ordered goods, factor in labor time and cost of operations and materials. These vary from order to order, so make an average estimate.

Budgeting is tricky for startups—you rarely have an existing model to use. Do your due diligence by researching industry benchmarks for salaries, rent, and marketing costs. Ask your network what you can expect to pay for professional fees, benefits, and equipment.

Set aside a portion of your budget for advisors—accountants, lawyers, that kind of thing. Budget business plan few thousand dollars upfront could save you thousands more in legal fees and inefficiencies later on. This business startup budget guide from The Balance is a great start. Figures in these industries—whether accounting, legal services, creative, budget business plan, or insurance—can vary greatly, which means budgets need flexibility.

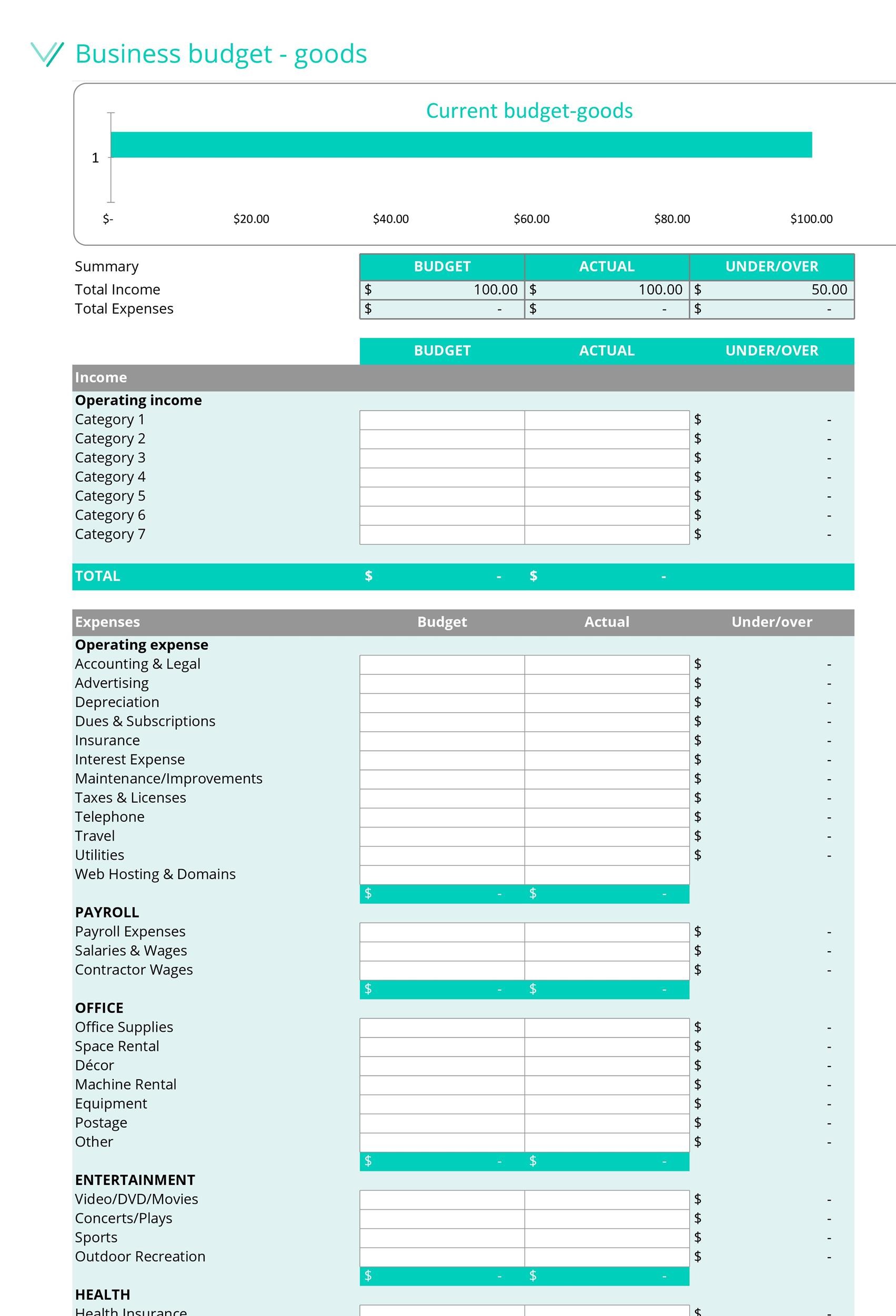

These figures are reliant on the number of people required to provide the budget business plan, the cost of their time, and fluctuating customer demand. A business budget template can be as simple as a table or as complex as a multi-page spreadsheet. The Balance has a clear table template that lists every budget item, the budgeted amount, the actual amount, and the difference between the two. Capterra has both monthly and annual breakdowns in their Excel download.

Google Sheets has plenty of budget templates hiding right under your nose. Smartsheet has budget business plan resources for small businesses, including month budget spreadsheets, department budget templates, projection templates, project-by-project templates, and startup templates.

Their budget template comes with step-by-step instructions that make it dead simple for anyone. Vertex42 focuses on Excel spreadsheets and offers templates for both product-based and service-based businesses, as well as a business startup costs template for anyone launching a new business. Check out our free guide, Bookkeeping Basics for Entrepreneurs, budget business plan.

If you need a bit more help, get in touch with us. We're an online bookkeeping service powered by real humans. Bench gives you a dedicated bookkeeper supported by a team of knowledgeable small business experts. Your bookkeeping team imports bank statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of bookkeeping. This post is to be used for informational purposes only and does not constitute legal, business, or tax advice.

Each person should consult his or her own attorney, business advisor, or tax advisor with respect to matters referenced in this post. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Sign up for a trial of Bench. No pressure, no credit card required. For Partners. By Amanda Smith on September 28, Contents What is a business budget? What makes a good budget? Small business budgets for different types of company Small business budgeting templates How Bench can help. Tired of doing your own books? Try Bench. Share this article. Get Started.

How do I Budget For Starting a Business?

, time: 4:33How to Create a Business Budget in 5 Steps - Due

A business plan budget example is smart to have when managing a company. It sets the outline for how much money you'll spend in your business and what you'll spend it on. This isn't a forecast, however, which is where you predict the future of your budget. A budget is Estimated Reading Time: 5 mins Business plan vs. budget: The scope. A budget only includes a financial forecast, whereas a business plan will also detail the commercial opportunity and the market, the company and its organisation and strategy over the next few years. The scope of the business plan Estimated Reading Time: 3 mins 41 rows · Jul 11, · A budget is an essential part of a business plan and is necessary for starting Estimated Reading Time: 4 mins

No comments:

Post a Comment